Swiss real estate funds and investment foundations on the CO2 reduction path: Update 2025

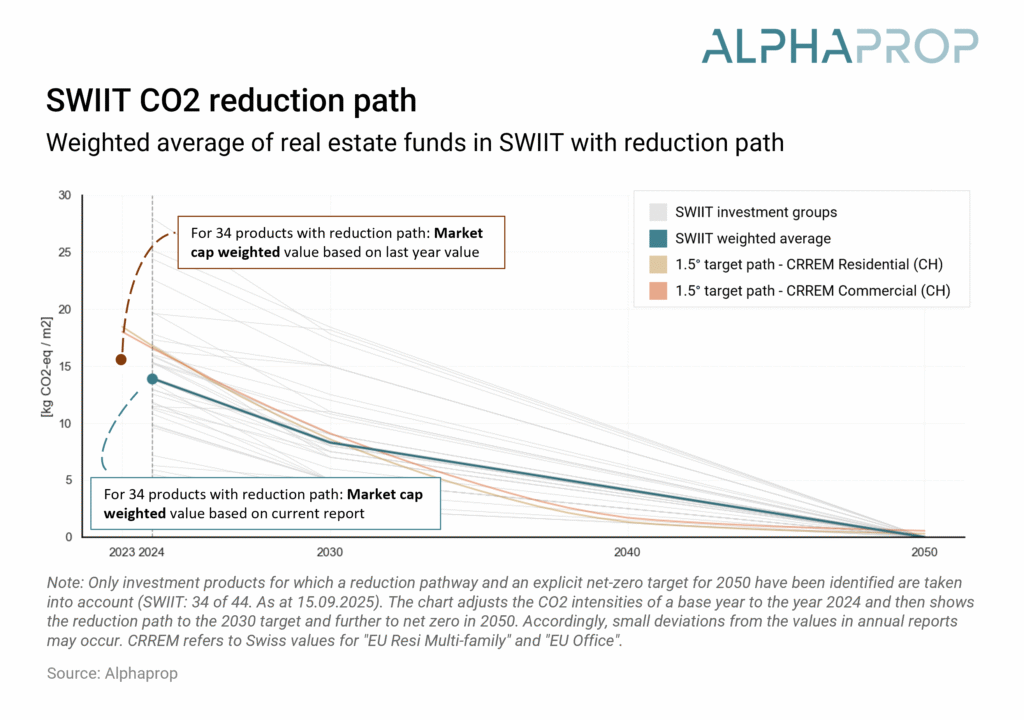

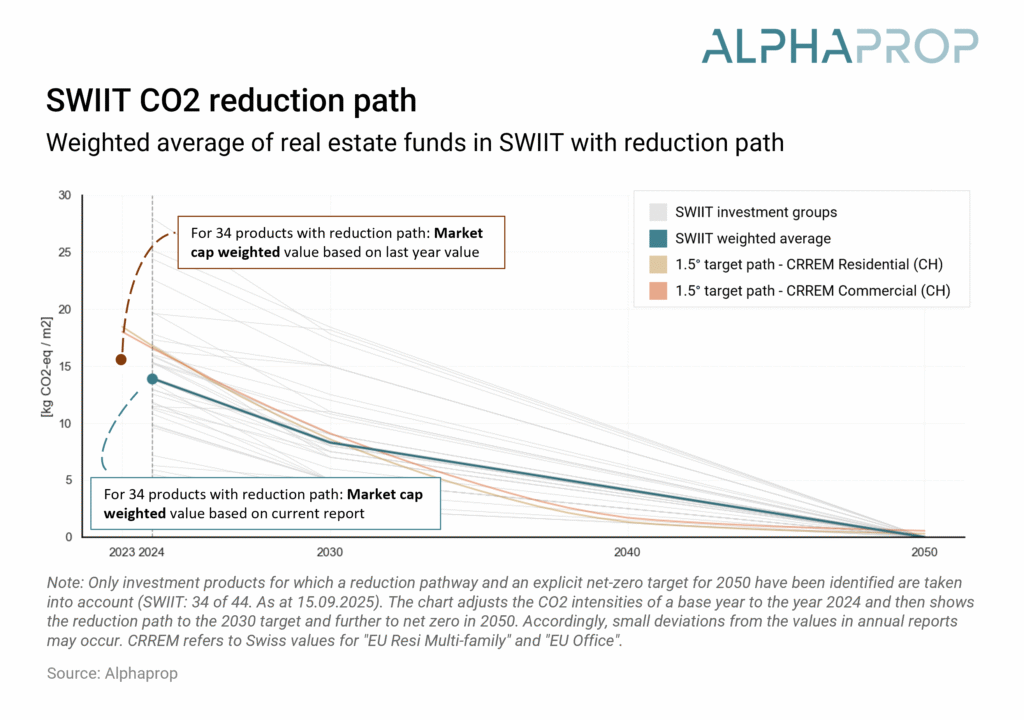

Where will the reduction path and environmentally relevant indicators for real estate funds and investment foundations stand in 2025? We examine the current state of reporting for indirect Swiss real estate investments.

Swiss real estate funds and investment foundations on the CO2 reduction path: Update 2025

Where will the reduction path and environmentally relevant indicators for real estate funds and investment foundations stand in 2025? We examine the current state of reporting for indirect Swiss real estate investments.

Alphaprop Celebrates 5-Year Anniversary and Expands Real Estate Offering

On the occasion of Alphaprop’s fifth anniversary, parent company and data analytics specialist Novalytica is consolidating its entire real estate expertise under the well-established Alphaprop brand. The aim is to focus even more closely on the needs of the real estate sector. The milestone will be celebrated with an exclusive client and partner event at the FIFA Museum in Zurich.

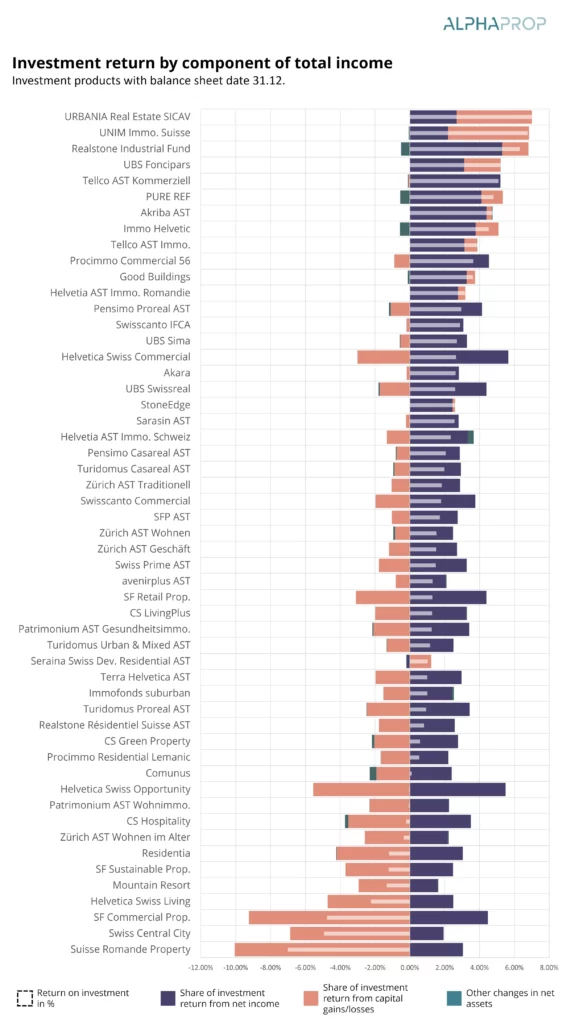

Rising discount rates depress investment returns: Indirect real estate investments in May 2024

The annual reports as at December 31 and the corresponding valuations were eagerly awaited again this year. The reports always provide an indicator of how the investment vehicles for indirect Swiss real estate investments are performing in an environment of higher interest rates.

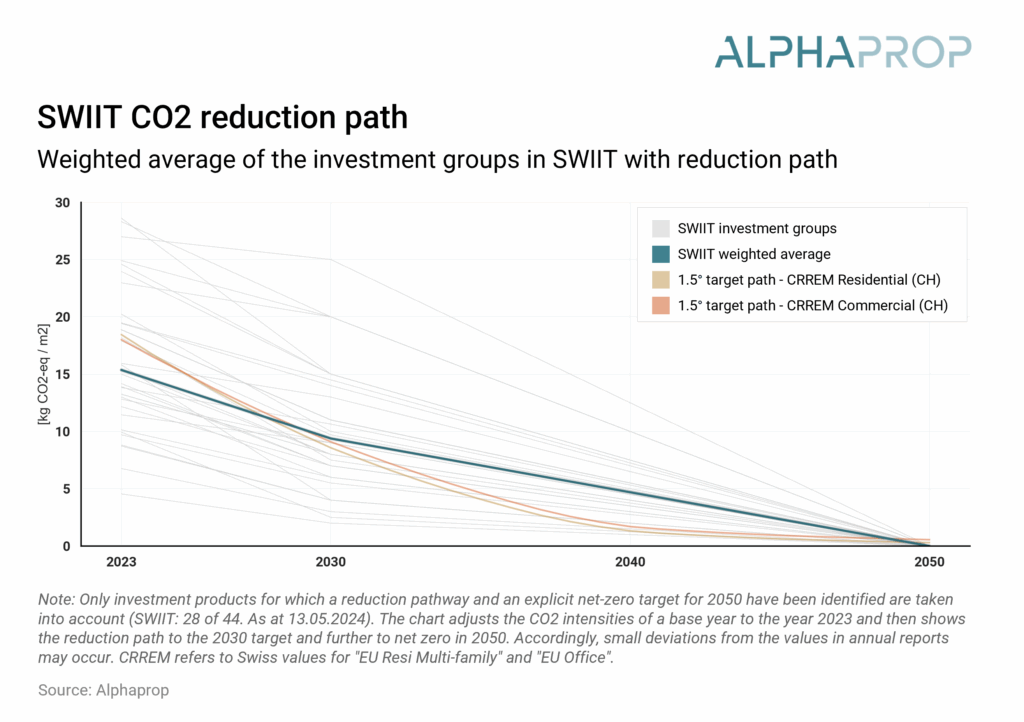

Indirect real estate investments and their CO2 reduction paths: Update 2024

Weighted by market capitalization, environmentally relevant key figures are available for 100% of the SWIIT and 95% of the KGAST. Around half of the investment products in both indices have a reduction path.

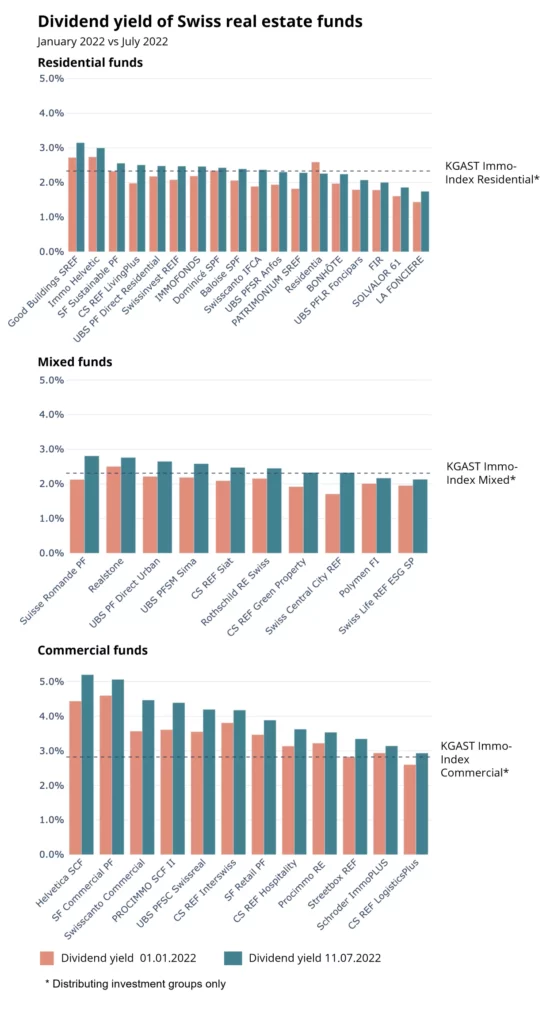

Dividend yields of Swiss real estate funds in 2022

With the change in the interest rate environment and the 50 basis point increase in the SNB policy rate, the environment for indirect real estate investments has changed. The SWIIT index of listed real estate funds plunged nearly 15% over the first 6 months of 2022. SIX-listed real estate stocks had a performance of -7% over the same period. After years of falling interest rates, falling discount rates and therefore increasing property valuations, the generated cash flow becomes now the main focus.